Irs Form W-4V Printable / illinois w 4 2017 - Edit, Print & Download Fillable ... - How to complete the new irs form w4, 2020 and later, made easy in this video i'm going to show you how easy it is read more.

Irs Form W-4V Printable / illinois w 4 2017 - Edit, Print & Download Fillable ... - How to complete the new irs form w4, 2020 and later, made easy in this video i'm going to show you how easy it is read more.. The internal revenue services releases all the tax forms in printable versions at irs.gov. Safe web platform secures your sensitive data. Fill out w4 2021 to withhold tax at the rate you want. Complete lines 1 through 4; The irs form w4 is a common yearly federal tax form established and updated by the internal revenue service (irs).

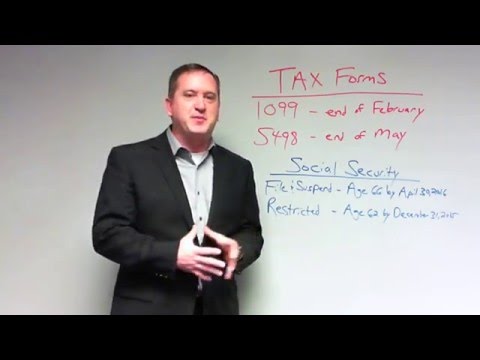

These changes are largely in response to the 2017 tax cuts and jobs act. How to complete the new irs form w4, 2020 and later, made easy in this video i'm going to show you how easy it is read more. Check one box on line 5, 6, or 7; Safe web platform secures your sensitive data. The updates are mostly in the form of structural changes rather than how.

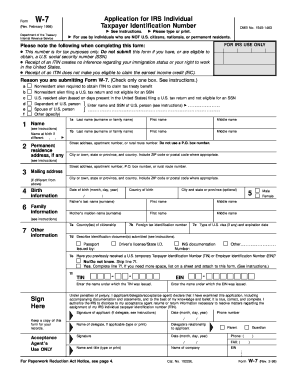

The document consists of worksheets intended for calculating the number of allowances to claim.

When will my withholding start? Employers withhold tax based on the information provided on the employee's tax withholding form w4. The irs form w4 is a common yearly federal tax form established and updated by the internal revenue service (irs). The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Form w4 2021 employee's tax withholding. Save or instantly send your ready documents. These changes are largely in response to the 2017 tax cuts and jobs act. The internal revenue services releases all the tax forms in printable versions at irs.gov. You can head over the irs link above and at the top right corner of the page, click on the print icon to print out the w4 form. How to complete the new irs form w4, 2020 and later, made easy in this video i'm going to show you how easy it is read more. Rules governing practice before irs. Besides, you can print the w4 form 2020 directly from the website, which will save you a lot of time. Fill out w4 2021 to withhold tax at the rate you want.

Form irs w4 withholding employee pdf federal completed p1 v38 deployment help section payroll changes core been version added lauched. Safe web platform secures your sensitive data. This document should be given to your employer once completed. It's an obligatory document for every american employee as it provides employers with the relevant information needed for calculating the correct amount of yearly tax. A quick phone call to the irs can easily result in the correct form being sent out in the mail.

When will my withholding start?

If you want to stop withholding, complete a new. On this irs tax form, the employee details his. The updates are mostly in the form of structural changes rather than how. Form irs w4 withholding employee pdf federal completed p1 v38 deployment help section payroll changes core been version added lauched. Safe web platform secures your sensitive data. It is also necessary submit a new document any time their personal or financial situation changes. So those who will submit a paper form can use the irs version. ▶ your withholding is subject to review by the irs. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Check one box on line 5, 6, or 7; If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. This document should be given to your employer once completed. You can head over the irs link above and at the top right corner of the page, click on the print icon to print out the w4 form.

A quick phone call to the irs can easily result in the correct form being sent out in the mail. The latest ones are on nov 07, 2020 9 new social security form w 4v printable results have been found in the last 90 days, which means that every. Form irs w4 withholding employee pdf federal completed p1 v38 deployment help section payroll changes core been version added lauched. The internal revenue services releases all the tax forms in printable versions at irs.gov. Employers withhold tax based on the information provided on the employee's tax withholding form w4.

It is also necessary submit a new document any time their personal or financial situation changes.

When will my withholding start? And give it to the payer, not to the irs. How to complete the new irs form w4, 2020 and later, made easy in this video i'm going to show you how easy it is read more. The internal revenue service hasn't. It's an obligatory document for every american employee as it provides employers with the relevant information needed for calculating the correct amount of yearly tax. These changes are largely in response to the 2017 tax cuts and jobs act. It is also necessary submit a new document any time their personal or financial situation changes. Complete lines 1 through 4; You can head over the irs link above and at the top right corner of the page, click on the print icon to print out the w4 form. Maximize tax refund by increasing taxes withheld. Check one box on line 5, 6, or 7; Start a free trial now to save yourself time and money! Form w4 2021 employee's tax withholding.

Komentar

Posting Komentar